In finance, no tenet is more fundamental than the relationship between risk and return. There is no such thing as a free lunch, they say – you don’t get higher returns without taking higher risk. Increasingly strong empirical evidence from the Oslo Stock Exchange proves that this is fundamentally wrong.

Strictly speaking, the theoretical construct is about expected return. We can safely conclude, however, that this is a case of unmet expectations:

As lunch bills go, actual returns are way off the charts.

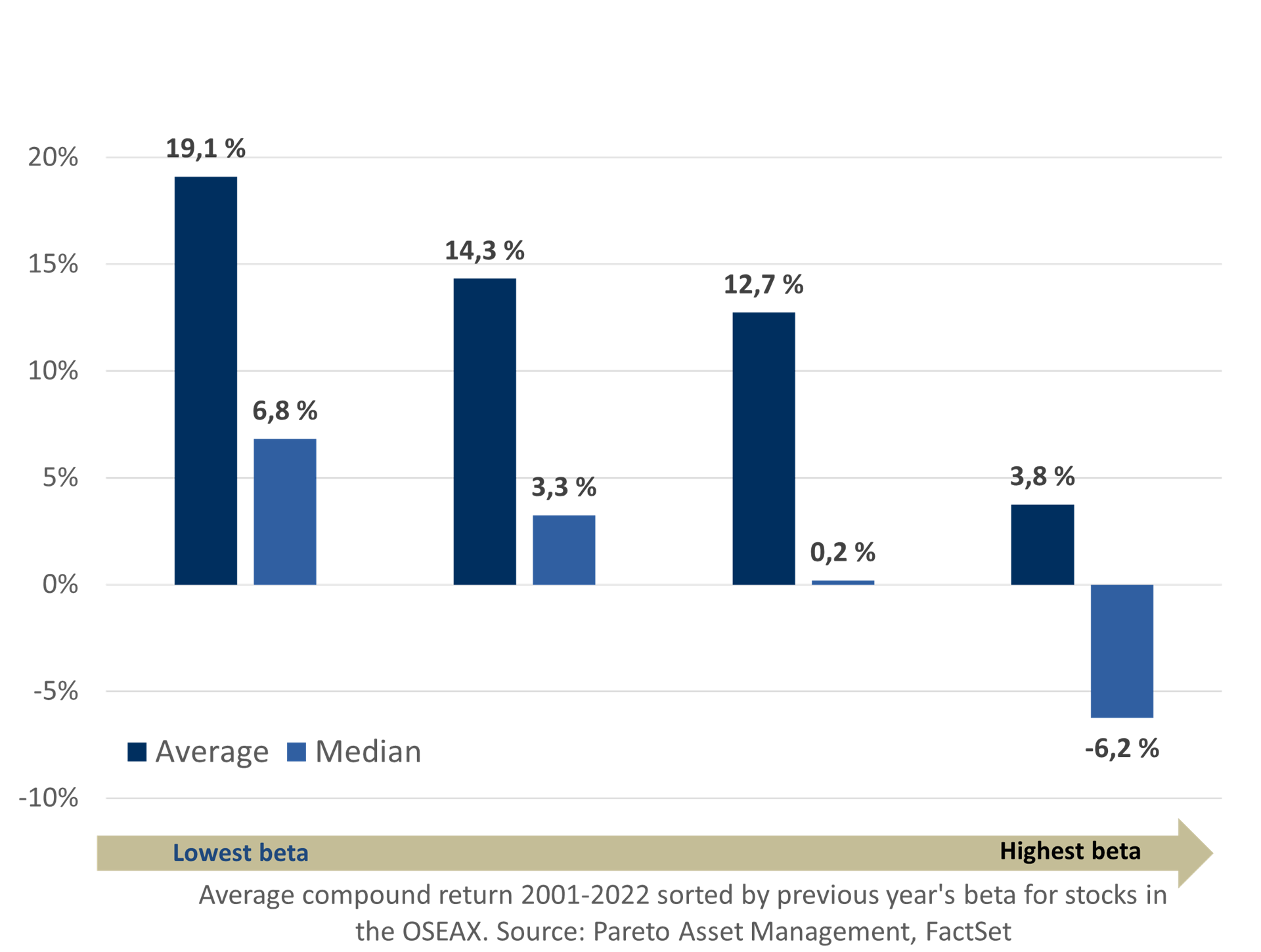

In financial theory, it is market risk that counts, as measured by beta. With a beta of 1.0, the stock fluctuates in line with the market, and with a beta of 1.5, the fluctuations are 50 per cent greater. A few years ago, I calculated that a higher beta would have yielded lower returns for Norwegian equities, not higher – as has also been seen in the US market. This is called the low-beta anomaly. An update provides even more significant results:

If, every year since 2000, you had invested in the previous year’s highest beta quartile in the Oslo Børs All-share index, you would have had an average return (equally weighted) of 3.8 per cent. If, on the other hand, you had singled out the lowest beta quartile, you would have had an average return of 19.1 percent.

Expensive excitement

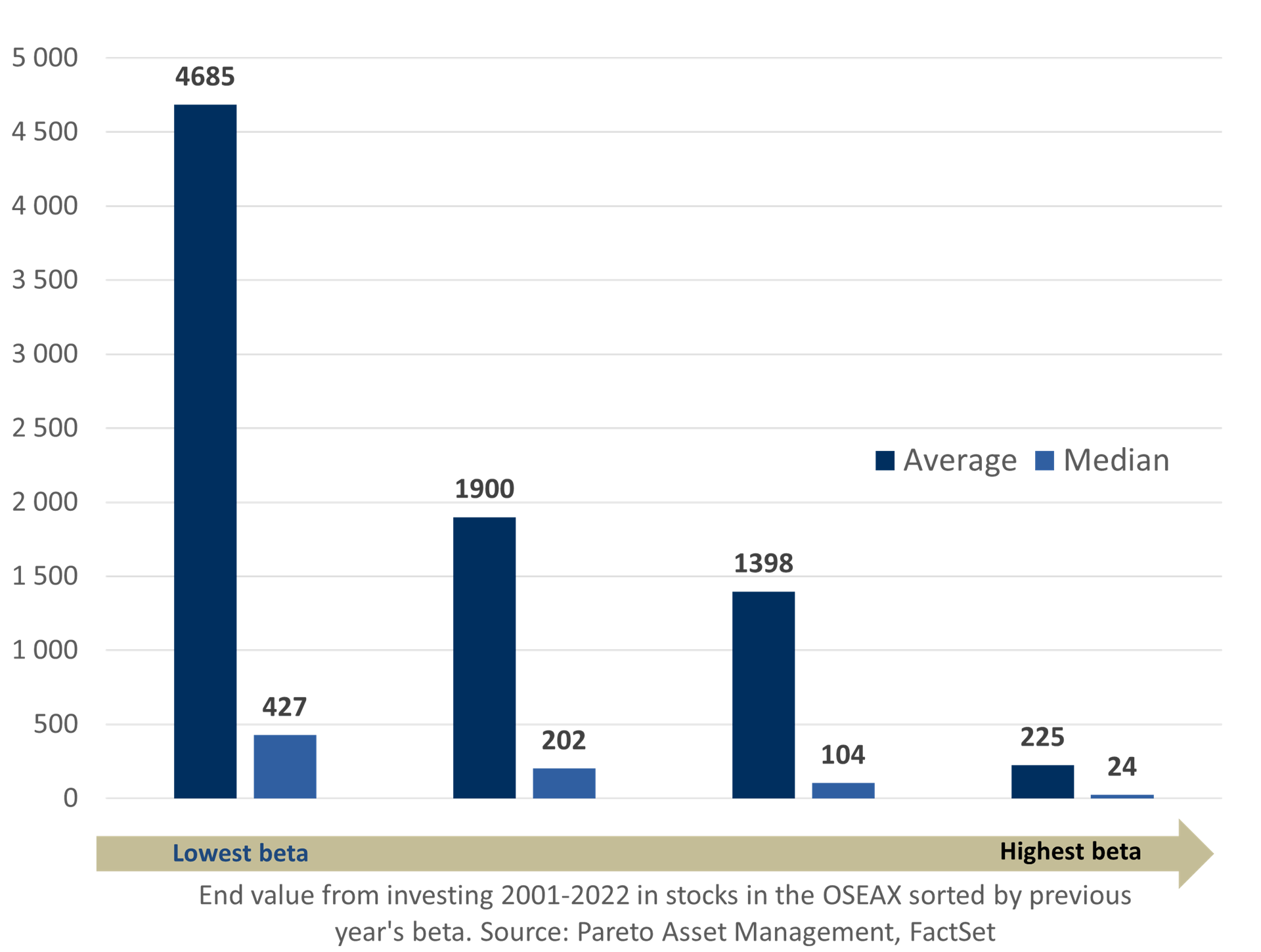

Put another way: The proverbial NOK 100 bill would have grown to NOK 225. Or NOK 4,685. A difference, that is, of NOK 4,460. Here, boring truly is the new exciting. You would have been paid handsomely well for taking less risk.

And if you had hit the median in the riskiest quartile, you would have lost more than six per cent a year. This figure is so low because you would have missed out on some fantastic stocks that saved the average return from total collapse.

Know what to compund!

The hunt for such fantastic stocks is probably an important reason for the puzzling relationship. If it is true that eight out of ten men overestimate their own driving skills (I don’t, of course), it is probably the case that many investors consider themselves better than average. They overestimate their own ability to find the next decade’s winners.

Financial researchers talk (write) about lottery-like stocks, i.e. stocks where the rewards are astronomical and the probability of winning is extremely low. No doubt looking for the next e-commerce giant, car comet or vaccine blockbuster is exciting, but I’d say it rather resembles kissing a frog – whereby the prince or princess fails to appear.

Good research should be replicable. This experiment is easy to repeat. Head for the woods, find a pond and look for frogs. What happens when you kiss them?

Or go hunting for shooting stars in the stock market.