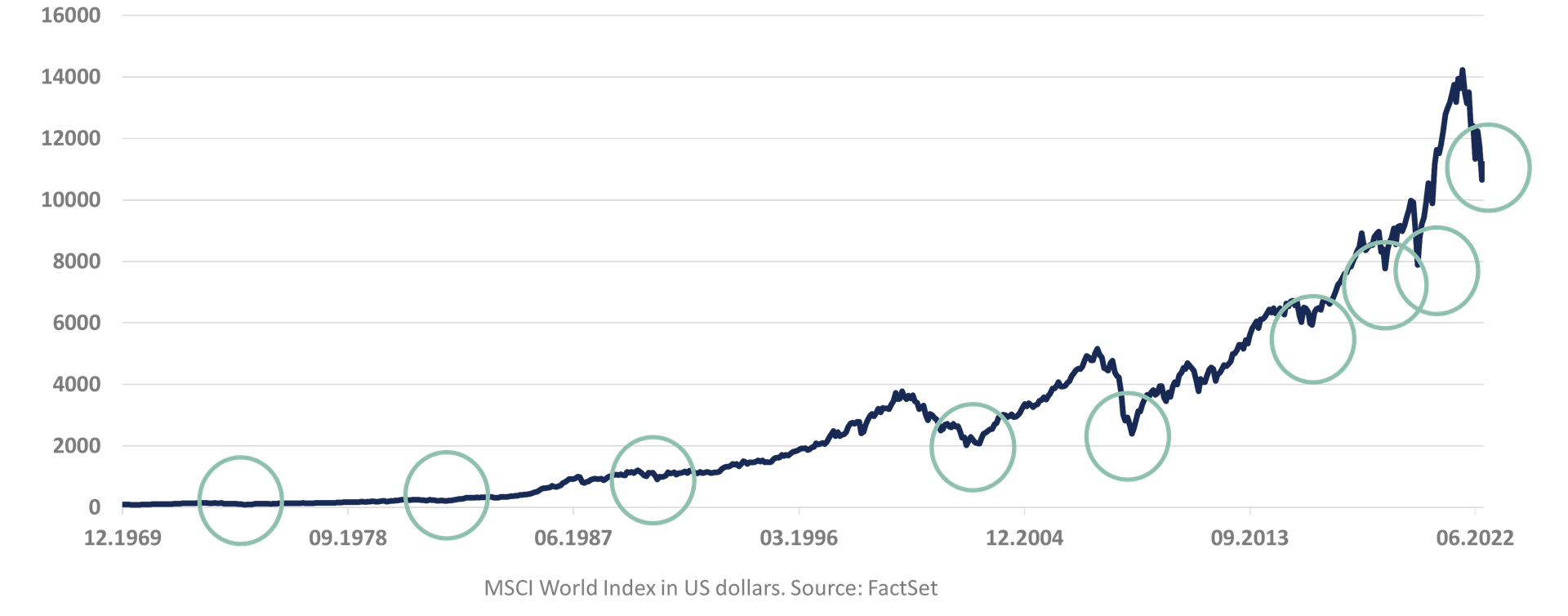

Imagine investing at every rock bottom in the stock market. After the great financial crisis, for instance. At the peak of the pandemic panic, perhaps, in March 2020. Or maybe at the end of the bear market following the bursting of the dot-com bubble.

Surely a great way to achieving financial returns beyond compare? Just takes a bit of luck, that’s all.

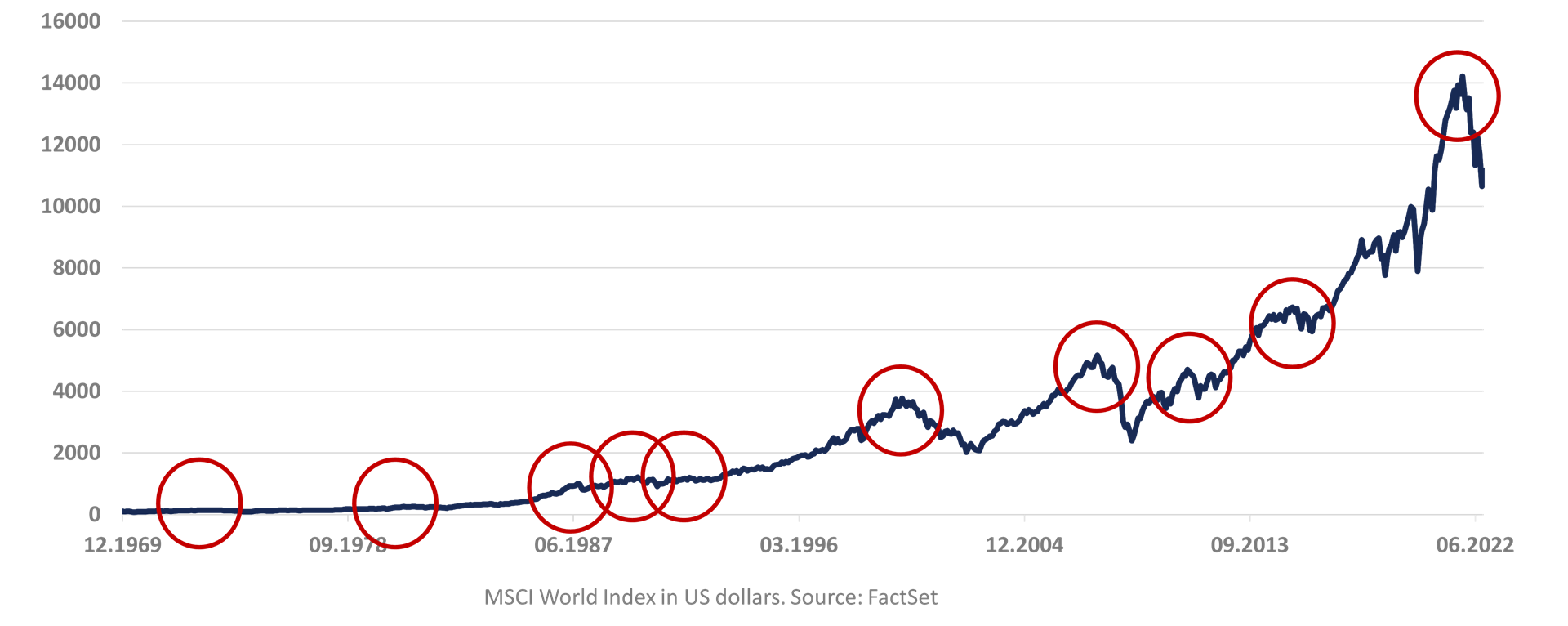

Some of you may feel that this is a better description: You happened to invest at the very top – each time. In 1987, in 2000, in 2007 … only to see your investment portfolio eroding at record speed.

How bad can that be?

9.3%, which would have transformed that original 100-dollar bill into more than $11,000.

Your lucky cousin started with the same amount of money and then invested another $100 every time the world index hit rock bottom, an opportunity that presented itself nine times in the following years. His fortuitous money-weighted return: 9.9%

Imagine investing at all the interim lows ...

These are the firesale moments in the MSCI World Index

Yes, he would beat the index, and yes, thanks to the power of compound return, his terminal value would be more than $14.500. But, honestly, cross your heart and hope to default, didn’t you expect a much larger difference?

Let’s look instead at the investor who is constantly down on his luck. Same starting point (to ensure equal time in the market), similarly good at finding the turning points – just getting the signs wrong. In this case, compound return is close to 9.0%.

… or imagine investing at the very top every time

There is no worse timing conceivable, at least not for buying

There’s no misprint here: Investing at every significant market high would have produced an average compund return of just 0.9 percentage points less than the systematically lucky investor.

Again, the magic of compound return would amplify the difference. While the difference between good and bad timing may be a lot smaller than you thought (it sure was for me), there’s no hiding the disadvantages of always getting your timing wrong.

You could, however, have done a lot worse: You could have had all your money in a bank account.