The company was rattled by Apple's new iPhone and Google's fantastic growth. The market was disappointed and sent P/E multiples down from over 25 to below 10.

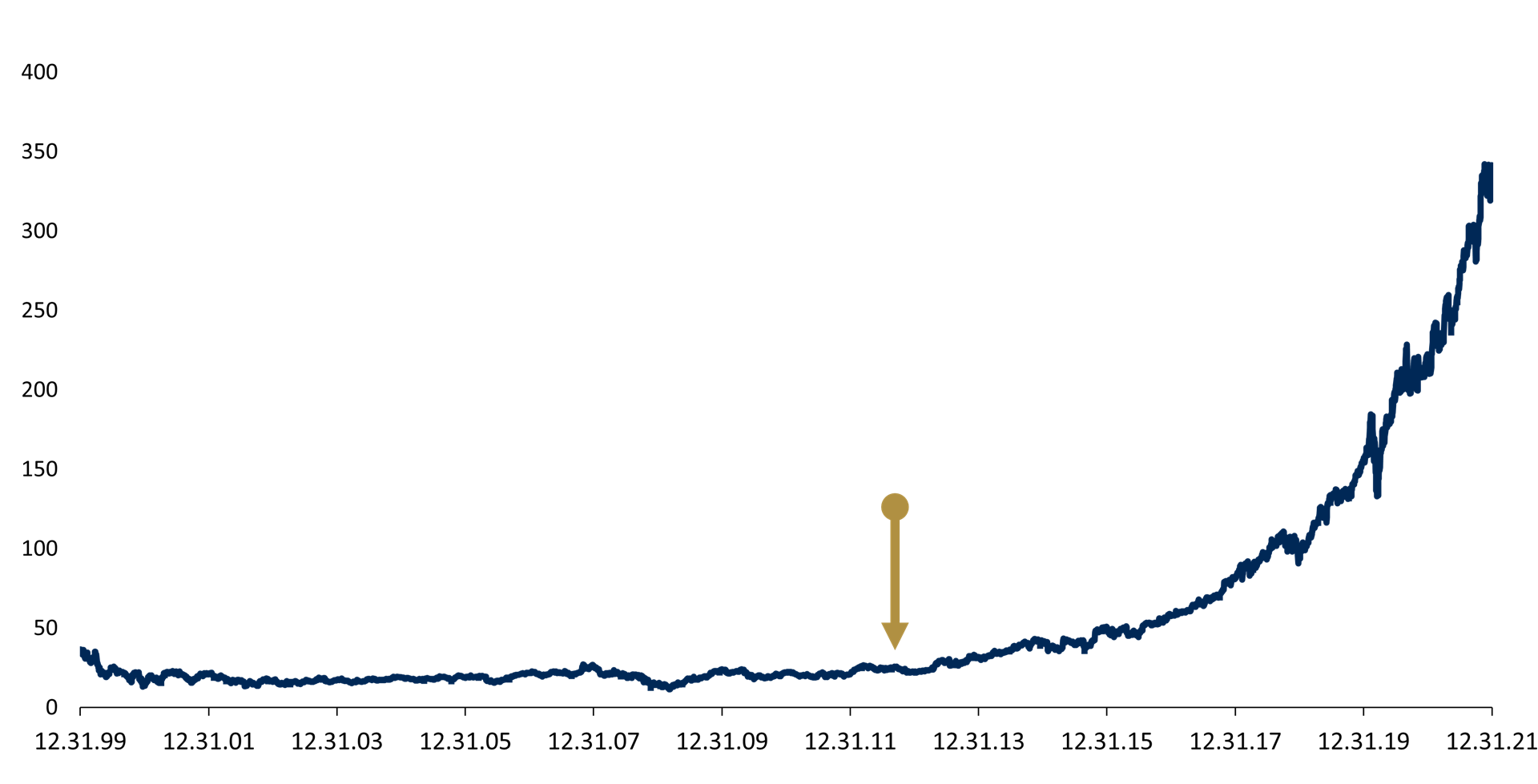

In November 2012, Pareto Global bought Microsoft. The stock was cheap, but earnings were weak. Over the next four years, there was zero growth in earnings per share.

The lack of growth did not come as a shock to the portfolio managers, though. Microsoft was in the process of implementing a strategic shift, from up-front revenues to annual revenues from ongoing licenses and subscriptions. Cloud-based solutions were about to replace one-time licenses from sales of personal computers with Windows operating systems.

The problem was that costs came immediately, while revenues would only roll in over the next few years. The transition to subscription revenues thus put pressure on earnings in the short term. The market did not applaud.

In 2017, the cloud investment began to pay off, and earnings accelerated. In recent years, the average earnings growth has been over 20 per cent.

And now the market applauded. Since Pareto Global's initial investment, pricing has roughly tripled, contributing to a further price increase. Total return during these nine years is approaching 2,000 per cent, corresponding to a compound return of almost 40 per cent. Today, Microsoft is the world's second largest company, measured in stock market capitalisation.

Why aren't the managers selling now? Because they see good, further growth for a well-run company which last year increased earnings per share by 38 per cent. After all, it is the commercial success of the company that drives long-term stock returns.

Portfolio management team

Historical returns are no guarantee for future returns. Future returns will depend, inter alia, on, market developments, the portfolio manager’s skill, the fund’s risk profile, as well as fees for subscription, management and redemption. Returns may become negative as a result of negative price developments. This is marketing communication.