One likely explanation is that people tend to make up their minds at different speeds. Some offload their stocks at the very first sign of trouble, while others wait and see. And market moves carry information in their own right: When stocks keep rising, there might just be some good reason that you haven't had time to see yet. After all, if there's a bunch of people waiting in line outside a department store, you can assume there are bargains to be had. (Ho ho, and Merry Christmas).

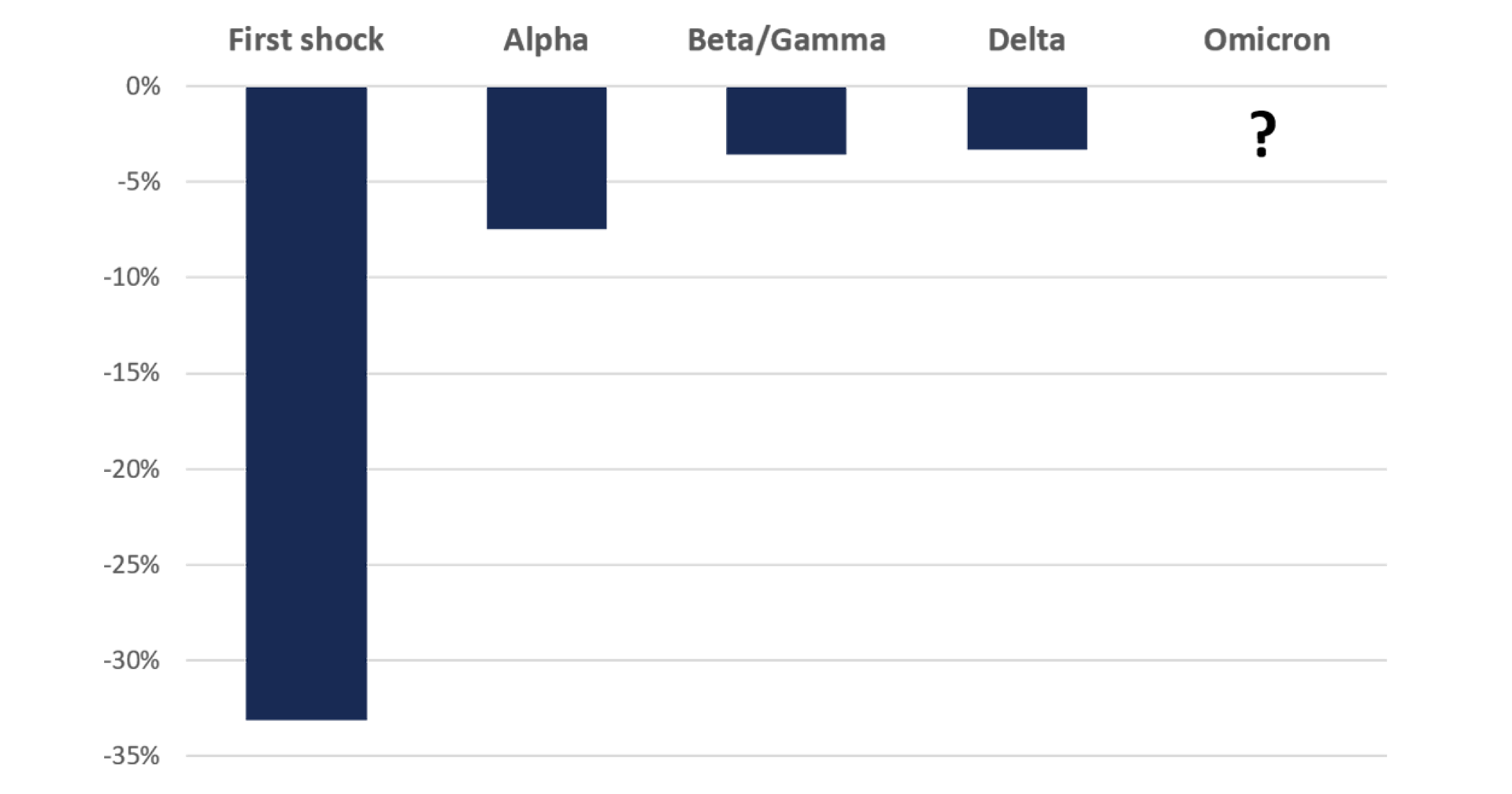

If there's a succession of similar events, however, we see signs of learning. One fun case in point is the reaction to news of the Covid-19 virus. Just look at these drawdown figures, showing the shortfall from previous highs in the MSCI World Index in local currency:

Learning to cope

While the initial pandemic shock of March 2020 brought a drawdown of 33%, the Alpha variant took 7.5 %, the Beta/Gamma variants (appearing almost simultaneously) ate away 3.6% and the Delta only 3.3%.

We might have hoped that the Omicron variant brought an even more muted reaction. However, it may be more dangerous than the other mutations (in which case extrapolating growing problems does not take that much imagination).

And this time, apprehension about Omicron coincided with statements from Jerome Powell, Chair of the US Federal Reserve and just nominated by President Biden to serve a second term, that bond-buying tapering might be speeded up, on fears of inflation getting stickier – although he did not phrase it quite like that. How about extrapolating some rate hikes?

Anyway, by the end of November, the drawdown stood at 3.7 per cent, only to reach 4.3 per cent the very next day. It is probably too early to conclude on the final drawdown on this occasion, but we know that there's learning in more than financial markets:

We have learned to cope with the virus, from wearing face masks to making society function under partial lockdown. We have learned to produce, distribute and administer vaccines. And we have learned that economic policy countermeasures do work.

Furthermore, we have a bit of catching up to do in the real economy. Judging from economic forecasts, a lot of bad stuff has to happen for 2022 to be something other than a year of extraordinary growth. Putting a little bit of faith in earnings estimates, much has to go wrong for companies not to enjoy strong earnings next year.

So ... it's just hunch, but maybe, just maybe, fears are overblown this time too?

Historical returns are no guarantee for future returns. Future returns will depend, inter alia, on, market developments, the portfolio manager’s skill, the fund’s risk profile, as well as fees for subscription, management and redemption. Returns may become negative as a result of negative price developments. This is marketing communication.