The price of gold is up by more than 40% in just 20 months, despite having retreated slightly from its peak in May. This has spurred renewed interest in gold as an investment. The classical arguments relate to gold as a safe haven, a protection against tribulations such as geopolitical unrest and inflation. As for the recent runup, strong demand from China, not least the People’s Bank of China, seems to be an important factor.

According to CBS News, one of many news sites to comment on the recent spike, “there's a good chance that gold prices will continue to increase over time, even if prices dip along the way, as gold has historically steadily increased in value over the long term.”

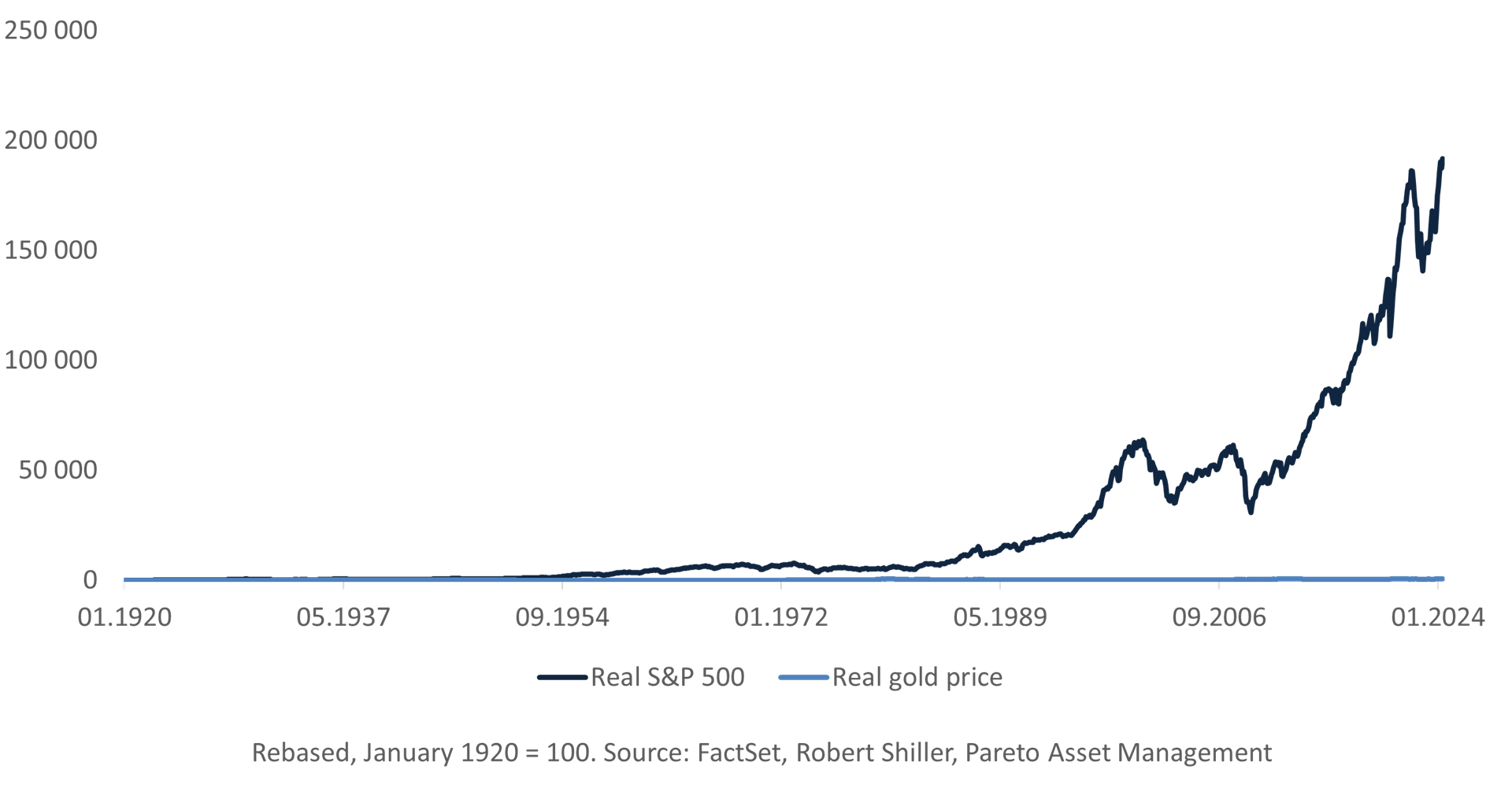

Well, no. Inflation makes pretty much everything increase in value over the long term, so let’s look at the real gold price, adjusted for inflation. The chart goes back to 1920, which surely qualifies as long term. As gold is quoted in dollars, prices are adjusted for US inflation. And as I’ve included the S&P 500 index (total return) in the same chart, we need a magnifying glass to spot the gold price – it’s right down there with the X axis.

Can you discover gold in this chart?

Put another way: If, in 1920, you had sold your gold bar to buy stocks instead, you could now sell your stocks and buy back more than 280 gold bars.

OK, let’s fast forward a bit. In August 1971, President Nixon suspended the dollar’s convertibility into gold (it was later cancelled indefinitely). Over the next eight plus years, until early 1980, the dollar lost a lot of value through inflation that peaked at almost 15%, while gold increased by more than 1,800%. In real terms, the gold price rose eightfold. No wonder gold acquired a reputation for inflation protection.

There’s more to the story, however. You see, the real price of gold has never managed to surpass its January 1980 apex. Hence, when new all-time highs are called, it’s not really true. In real terms, gold peaked more than 44 years ago, despite lots of “safe haven”-prompting events like outright wars, interest rate rollercoasters and bouts of inflation. In the meantime, the S&P 500 has delivered a real return of close to 3,500%.

Considering that gold needs to rise by very little to set a new (true) all-time high, however, maybe it’s finally time for that record to be broken?

Sure. Or maybe. In my view, it’s still a poor investment case. I may be stating the obvious here, but let me remind you of some of gold’s key figures:

- Revenues: 0

- Revenue growth: 0

- Earnings per ounce: 0

- Earnings growth: 0

- EBITDA: 0

- Free cash flow: 0

- Dividend yield: 0

- Coupon: 0

In contrast to real companies making real profits, gold has no return-generating function. You only make money if you find somebody who is willing to pay more than you did. While there seems to be a long line right now, from central banks to jewellery buyers, at some point you may have to go mining for even greater fools.