How do you interpret the economic and financial impact of political outcomes? The short answer, according to a recent article in the Journal of Finance, is that your investment outlook is shaped by your political affiliation.

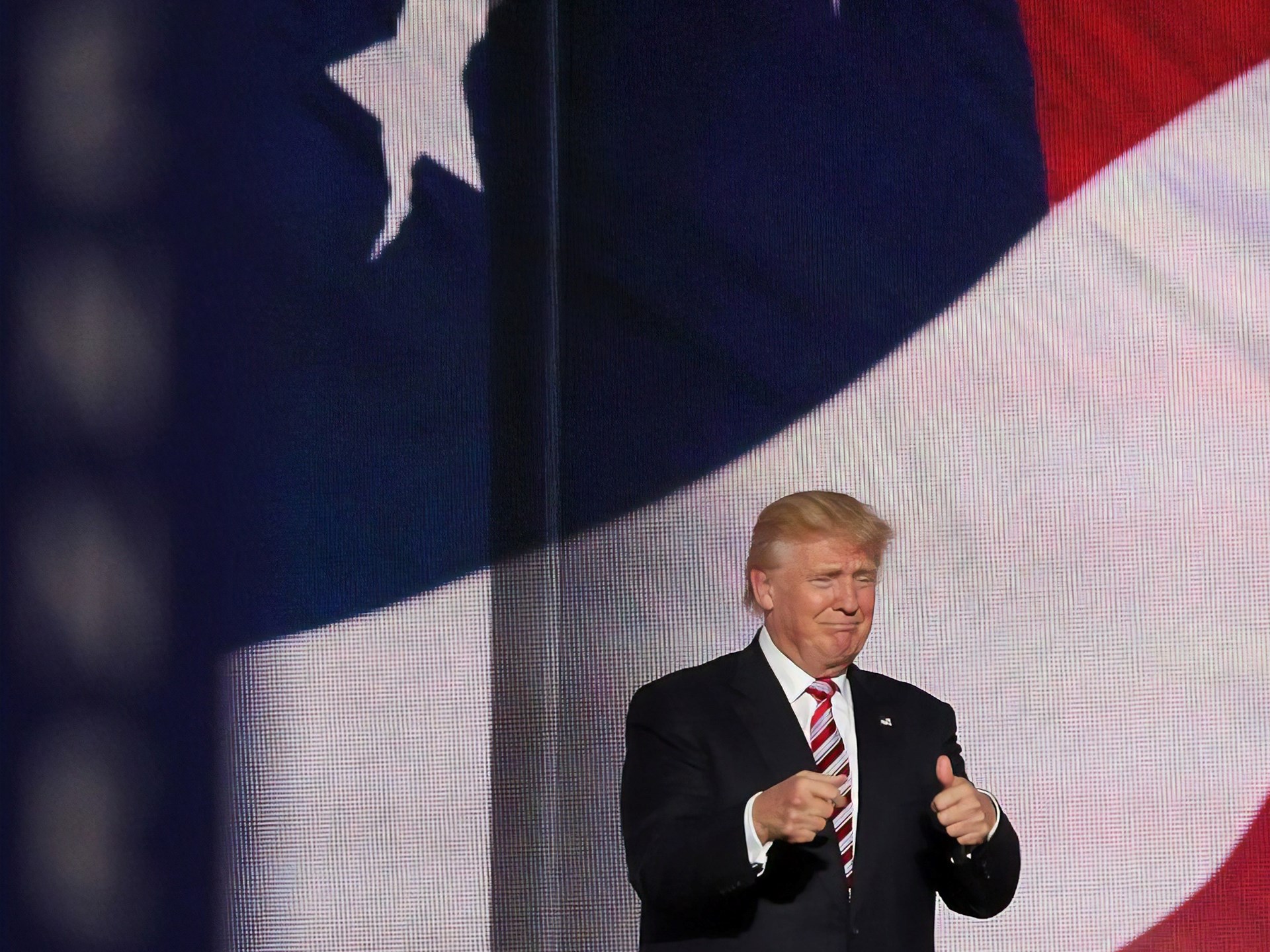

In 2016, to the astonishment of most pollsters (and the disbelief of many observers), Donald Trump was elected president of the United States of America. Volatile markets during the election campaign attested to the idea that the outcome would be important for financial markets. But how?

Chances are, if you voted for him, you became more optimistic about the US economy. If, on the other hand, you were displeased with the election, you turned a darker shade of gloom. That much was apparent from the University of Michigan Survey of Consumers.

The stock market, on the other hand, is supposed to be populated by rational investors. Did they adjust their portfolios according to their political views?

This is exactly what happened, according to four researchers at MIT, NBER, and Washington University in St. Louis. They had a clever idea – using zip codes as a proxy for political affiliation and then examining how investments developed across zip codes. As it happens, zip codes vary systematically in political donations as well as votes.

“Their main finding: presumed Republicans increased both their allocation to equity and their market beta following the election, while presumed Democrats did the opposite.”

It’s not like Republicans in droves poured more money into the stock market. Most of the measured effect comes from investors who changed their equity share by more than 25% after the election, with the largest reallocation among investors who actively reallocated their portfolios during the previous year. I.e., active investors were more susceptible to being influenced by their political outlook.

In case you wondered: The researchers controlled for variables like wealth, income, age, employer, regional impact (like industry subsidies), and market movements in existing portfolios.

The observed portfolio changes developed slowly. I guess this is compatible with the idea that people don’t really change their minds that often.

When I read this article, I found it very interesting. Now, come to think of it, why was I surprised?

Source:

“Belief Disagreement and Portfolio Choice”

Maarten Meeuwis, Jonathan A. Parker, Antoinette Schoar, Duncan Simester

Journal of Finance, December 2022