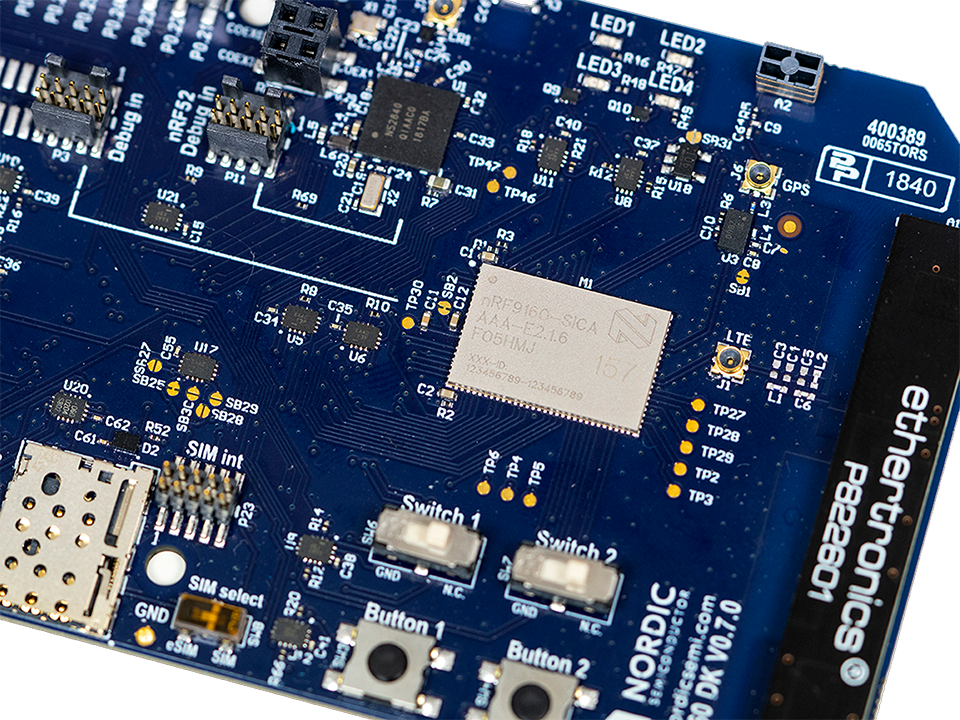

Nordic Semiconductor produces integrated circuits for low-energy, wireless technology, with keywords like Bluetooth and the Internet of Things.

The technology is developing at a rapid pace, meaning that yesterday's figures are generally irrelevant and tomorrow's figures may be anybody's guess. For a while even reported figures were misleading, as they included costs for a project that would only much later generate revenues.

Long-term ownership

Pareto Investment Fund held the stock before the fund became a part of the Pareto Group, in 2010. It was no easier back then to justify owning the stock by means of traditional multiples and the ensuing stock price development did not make it easier, with intermittent profit warnings and sudden declines – most recently when the Covid-19 panic raged most virulently last spring.

Nordic Semiconductor has been a stock for the strong of heart.

Kept the faith

The portfolio managers have nevertheless kept their faith in the technology and in Nordic Semiconductor as a case. And they have been very well rewarded.

Over the past ten years the stock has delivered a total return of 468 per cent, corresponding to an annual return of 19 per cent. A major part of this return came about last year, after a growing order book based on larger clients signalled more stable earnings and strengthened the market's belief in the company.

From the bottom in March the stock returned a full 322 per cent, whereas total return for the full calendar year was 148 per cent.

A classic growth stock?

Well, both yes and no. With the requisite technological understanding and insight, Nordic Semiconductor has appeared to be less of a gamble than reported figures may have led one to believe.

And with a decidedly long-term perspective, the portfolio managers have been able to reap the plentiful returns. This stock alone has contributed 22 percentage points of the accumulated return of 168 per cent in Pareto Investment Fund A over the past ten years.

Portfolio management team

The article is an excerpt from our 2020 annual report.

Historical returns are no guarantee for future returns. Future returns will depend, inter alia, on, market developments, the portfolio manager's skill, the fund's risk profile, as well as fees for subscription, management and redemption. Returns may become negative as a result of negative price developments.