Lead portfolio manager Tore Været has tripled the value of the balanced fund Pareto Nordic Return since 2007. We will now continue our success in the Nordic market through a brand new equity fund - Pareto Nordic Equity.

Why the Nordics?

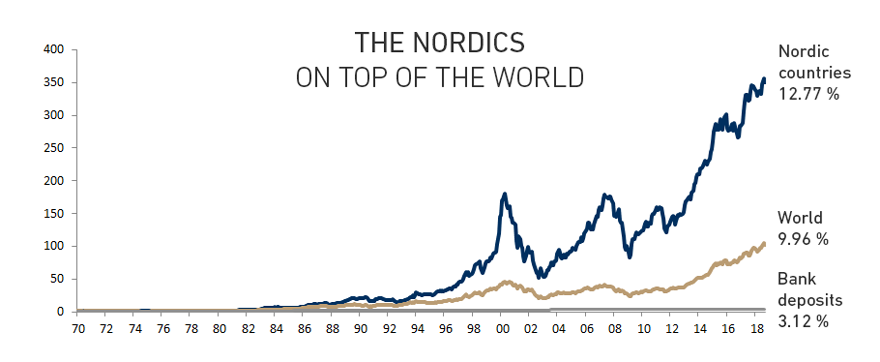

The Nordic countries have a proven track record of historical returns. NOK 1 million invested in Nordic equites in 1970 would have compounded to NOK 350 million today. Historical returns obviously do not guarantee future returns, but the success is hardly a coincidence:

- Expanding market: The world's 12th largest economy, growing faster than the eurozone

- Quality environment: Open economies, high productivity, technologically advanced

- Stable political and social regimes: Established legal frameworks and low inflation

- Quality companies: Nordic companies are known for high quality, good governance and transparency

Why Pareto Nordic Equity?

- Pareto Asset Management is a Nordic specialist with offices is Oslo and Stockholm

- 14 out of a total of 19 fund managers have the Nordics fully or partly as their investment mandates

- Risk management through diversification and comprehensive bottom-up analysis

- High capacity team with a proven track record led by Tore Været

- Building on the strong track record of the balanced fund Pareto Nordic Return

Pareto Nordic Return A had an accumulated return of 206.8 %, and 10.1 % annualized, during the period 1 January 2007–31 August 2018. Historical returns are no guarantee for future returns. Future returns will depend, inter alia, on, market developments, the portfolio manager's skill, the fund's risk profile, as well as fees for subscription, management and redemption. Returns may become negative as a result of negative price developments.