About us

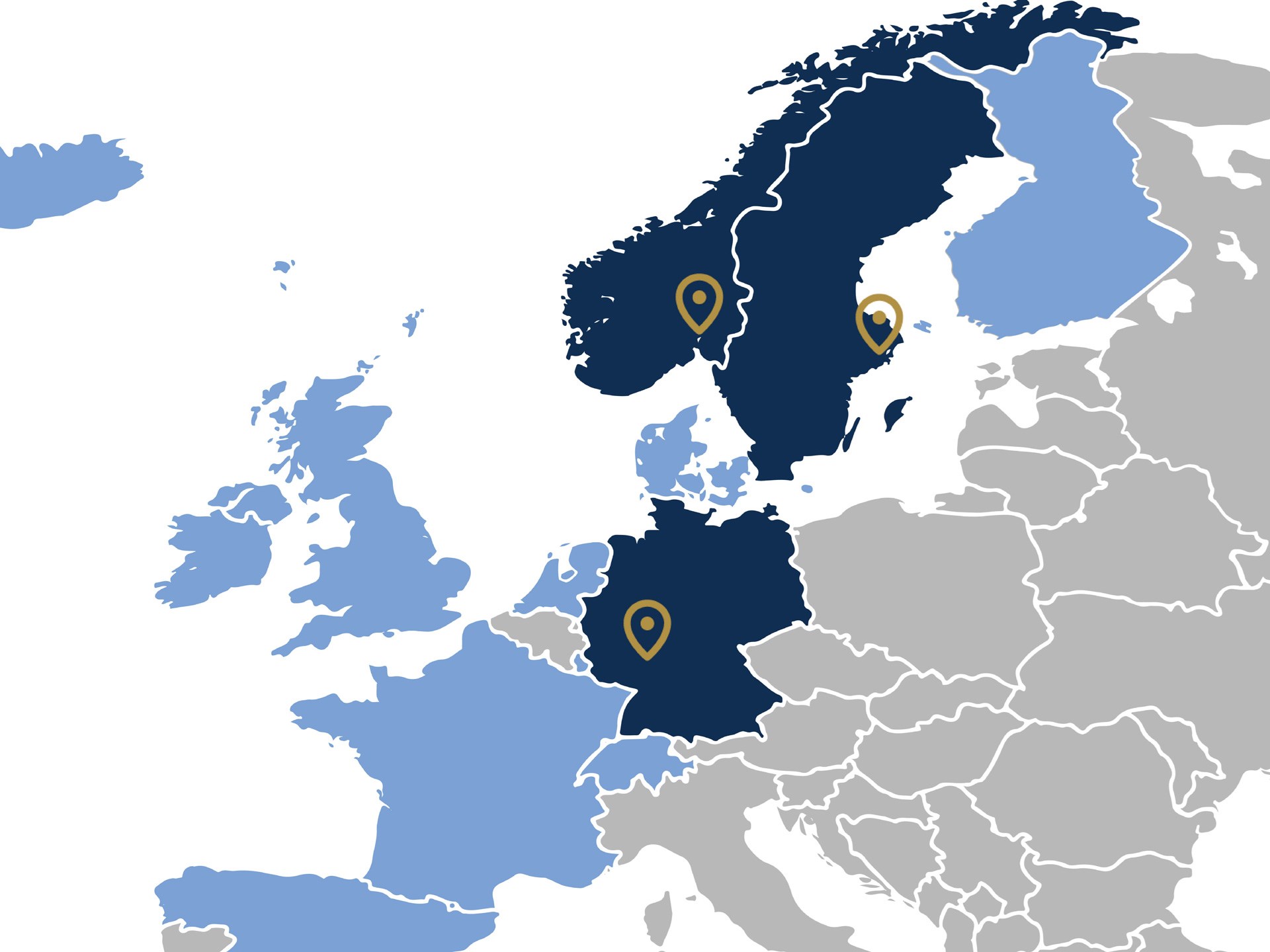

Pareto Asset Management is an independent boutique fund manager, with operations dating back to 1995. The company is part of the Pareto group, headquartered in Oslo, with branches in Stockholm and Frankfurt. We are an active fund manager, striving to deliver solid returns to our investors through active investment decisions.