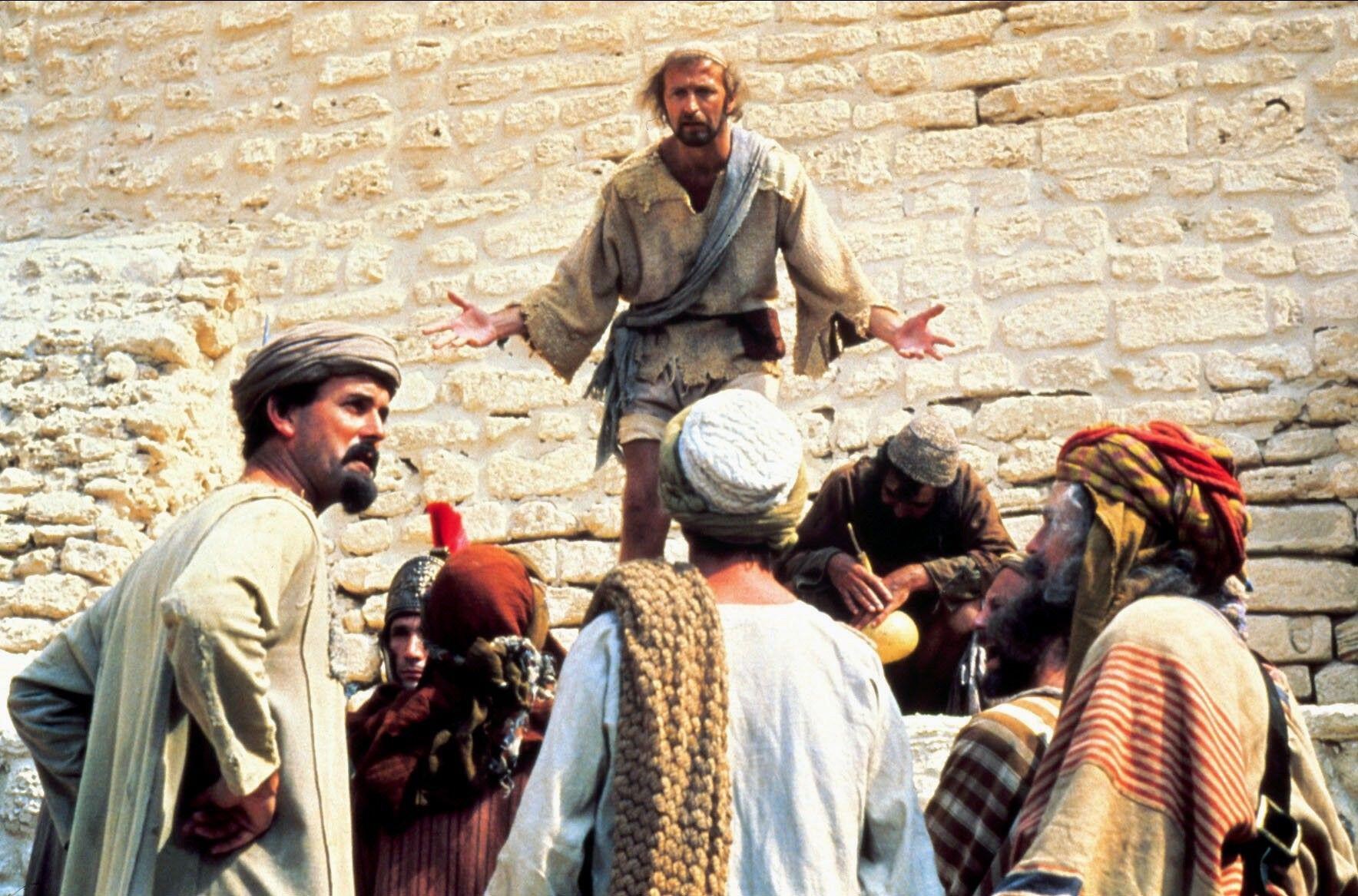

BRIAN: Look. You’ve got it all wrong. You don’t need to follow me. You don’t need to follow anybody! You’ve got to think for yourselves. You’re all individuals!

CROWD: Yes, we’re all individuals!

BRIAN: You’re all different!

CROWD: Yes, we are all different!

MAN IN THE CROWD: I’m not.

CROWD: Shh. Shhhh.

BRIAN: You’ve all got to work it out for yourselves!

CROWD: Yes! We’ve got to work it out for ourselves!

Strange choice of reference point in a report on responsible investing? There is in fact a logical link to our philosophy of active management. We believe in working it out for ourselves. Bear with me:

Much needed progress has been made on defining, classifying, and reporting on sustainability in European legislation. This is intended to help investors make better informed choices and of course to prevent greenwashing, thereby directing capital towards, and promoting, sustainable activities. I have yet to see anyone object to those goals.

As part of the European Economic Area, Norway regularly incorporates EU regulations into Norwegian law. A law combining the EU Taxonomy Regulation and the Sustainable Finance Disclosure Regulation was in fact passed in 2021. It is not expected to come into force until 2023, but all major asset management companies have long been working on adapting to this new legal and commercial environment. Pareto Asset Management is no exception.

We applaud this development and we do expect it to influence asset management outside Europe, as there is no other international body capable of chiseling out functioning cross-border legislation. We do, however, believe that such systems may act like kids’ shape sorters; only pre-defined shapes pass the test.

In order to classify as a “green” or sustainable activity, a company must contribute to at least one of six environmental objectives while not significantly harming any of them:

• Climate change mitigation

• Climate change adaptation

• Sustainable use and protection of water and marine resources

• Transition to a circular economy

• Pollution prevention and control

• Protection and restoration of biodiversity and ecosystems

In addition, there are social impact and technical screening criteria. To keep companies from bending these definitions to their own benefit, delegated acts specify further which activities can be defined as sustainable according to this legislation.

Fish farming is not defined as sustainable according to this system. It is easy to see why: There may be pollution from excess nutrients, fecal discharge or leaked chemicals, while escaped fish may spread diseases or interbreed.

If you want to be on the right side of the EU taxonomy, you will not invest in fish farming. If you can find a functional index that excludes activities not defined as green (good luck with that!), you will not be invested in fish farming.

We are. Our Norwegian equity mandates have long been invested in fish farming, and to good effect – at least in terms of financial returns. Did we also contribute to unsustainable activities?

We don’t believe so. While we recognise that there are negative consequences of fish farming, we honestly believe that they are far outweighed by the positive consequences.

First and foremost: Fish farming is a highly efficient way of producing animal proteins for human consumption. Whereas 100 kg feed produces 7 kg of edible cattle meat, 19 kg of pork and 39 kg of chicken meat, it yields as much as 56 kg of edible salmon.

This is not just a question of producing enough food for a growing global population. A critical issue is being able to produce the same amount food with a lower environmental footprint, from carbon emissions to requiring large tracts of land. Here, salmon farming reigns supreme.

Of course, we are attentive that fish farming is conducted in the best possible way. One such confirmation is the annual Coller FAIRR index of the world’s most sustainable protein producers. For four years in a row (and soon, we hope, five) several Norwegian fish farming companies have come out on top of this ranking.

“That’s what active management is all about. We’ve got to work it out for ourselves. And we do. ”

That’s no definitive guide, though. We’ve got to work it out for ourselves. We keep in touch with our portfolio companies, raising various issues of environmental, social or guidance relevance, pushing for more information if we are not satisfied. This is a source of information we cannot do without.

And so, we have invested in an industry that is not classified as sustainable according to the EU taxonomy. We believe that it does indeed score well on several parameters of sustainability. It’s just not on that list.

That’s what active management is all about. We’ve got to work it out for ourselves. And we do. Rest assured those are not accidental investments.