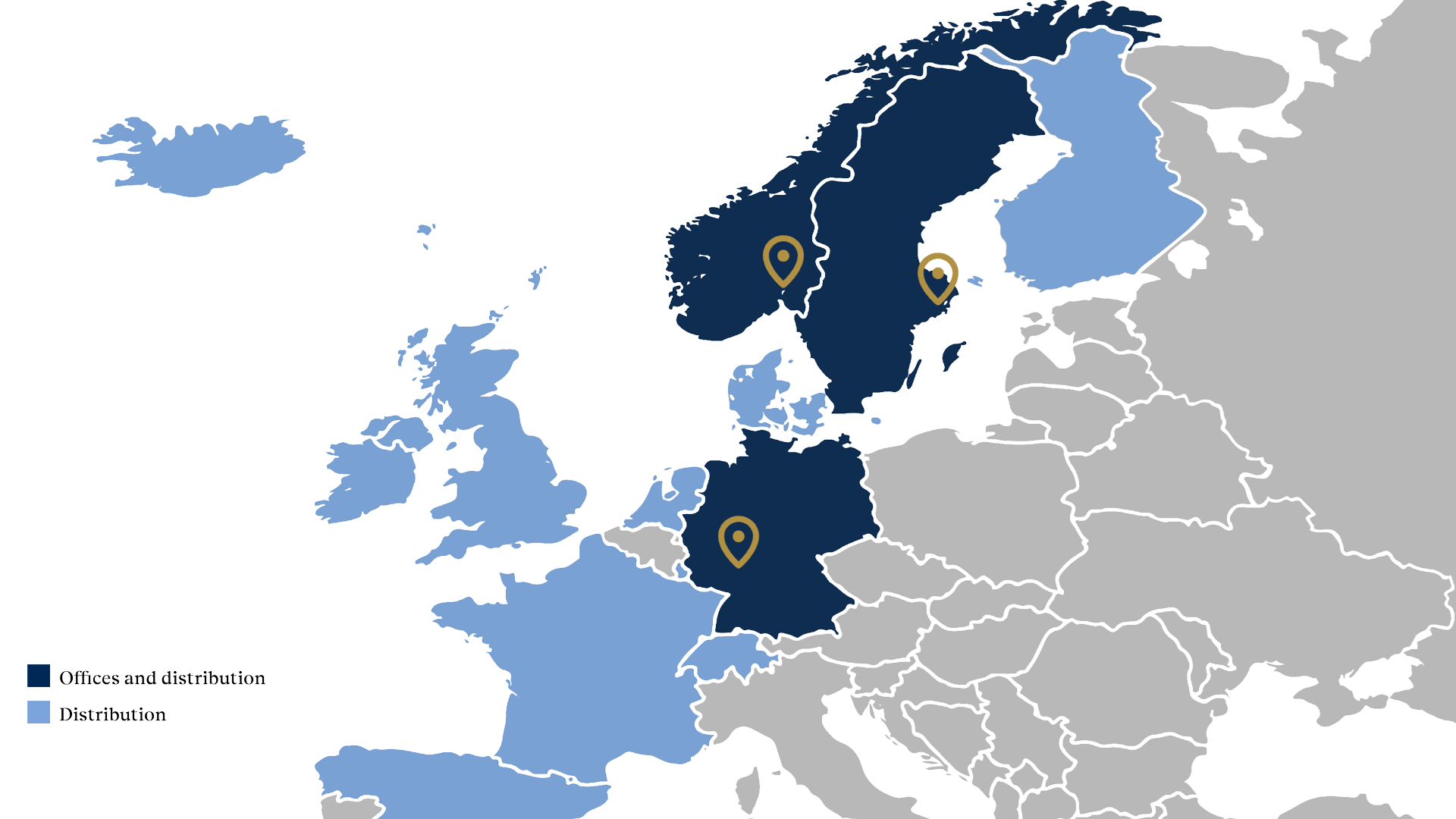

We manage funds for municipalities, foundations, pension funds, investment firms and private investors. Employees as well as owners of the Pareto group are heavily invested in our funds, and together, companies and employees constitute our largest customer.

Pareto Asset Management is a boutique fund manager, with a narrow and focused management. We consider our client relationships as long-term collaborations, and focus on maintaining a close relation to our clients.

Responsible Investment

Pareto Asset Management aims at contributing to sustainable development of markets and long-term value creation by investing in a responsible and ethical manner. We believe that responsible investments are important for achieving the best possible risk-adjusted return for our unitholders and clients. Sustainability and sound corporate governance give companies competitive advantages and contribute to long-term value creation.

The purpose of our guidelines for responsible investing is to prevent Pareto Asset Management from contributing to the violation of human rights, labor rights, corruption, environmental damage or other unethical actions.

“We believe that responsible investments are important for achieving the best possible risk-adjusted return for our unitholders and customers.”

UN Principles for Responsible Investment

As part of our efforts to promote responsible investments, Pareto Asset Management has signed the UN Principles for Responsible Investment (PRI). These guidelines are based on UN PRI, the UN Global Compact, the guidelines for the Norwegian Government Pension Fund Global, the Principles for the exercise of ownership rights in investment companies from the Norwegian Fund and Asset Management Association, as well as internationally recognised principles and conventions.

Pareto Asset Management shall exercise active ownership in the portfolio companies in order to promote responsible business operations. This means that we will use our ownership rights and influence in the companies to help move the companies in a positive direction in terms of social relations, environmental issues, sustainability and good corporate governance.

Read more

Pareto Asset Management is a proud member of Swesif, Norsif and the Norwegian Fund and Asset Management Association (VFF). The company's Chief Economist & Strategist, Finn Øystein Bergh, is a member of the board of Norsif.

Selected highlights from our history

- 1995: The inception year of our equity management

- 1998: The beginning of our fixed income management

- 2006: The beginning of our global equity management

- 2014: We opened our Stockholm branch

- 2014: We signed the UN's Principles for Responsible Investment

- 2015: We merged with Pareto Nordic Investments

- 2015: The beginning of our global fixed income management

- 2017: Accumulated return for our clients reached NOK 30 billion since inception

- 2018: Opened our first non-Nordic branch in Frankfurt, Germany

- 2018: Pareto Global Corporate Bond is the first fixed income fund in Sweden to receive the Nordic Swan Ecolabel

- 2019: Acquires Swedish Enter Fonder AB from Pareto Invest AB