Judging from other comments, many investors seem to see the latest all-time high as a reminder of the risk inherent in equities, of the high volatility and perhaps high pricing in today's market. Each new high inevitably inspires some acrophobia, it seems (a fear of heights, that is). Having climbed this high, the market must surely ...

If you do take frequent all-time highs as a sign of risk, let me point out that, well, you're wrong. It is the other way around: The market will reach new highs more often if volatility is low.

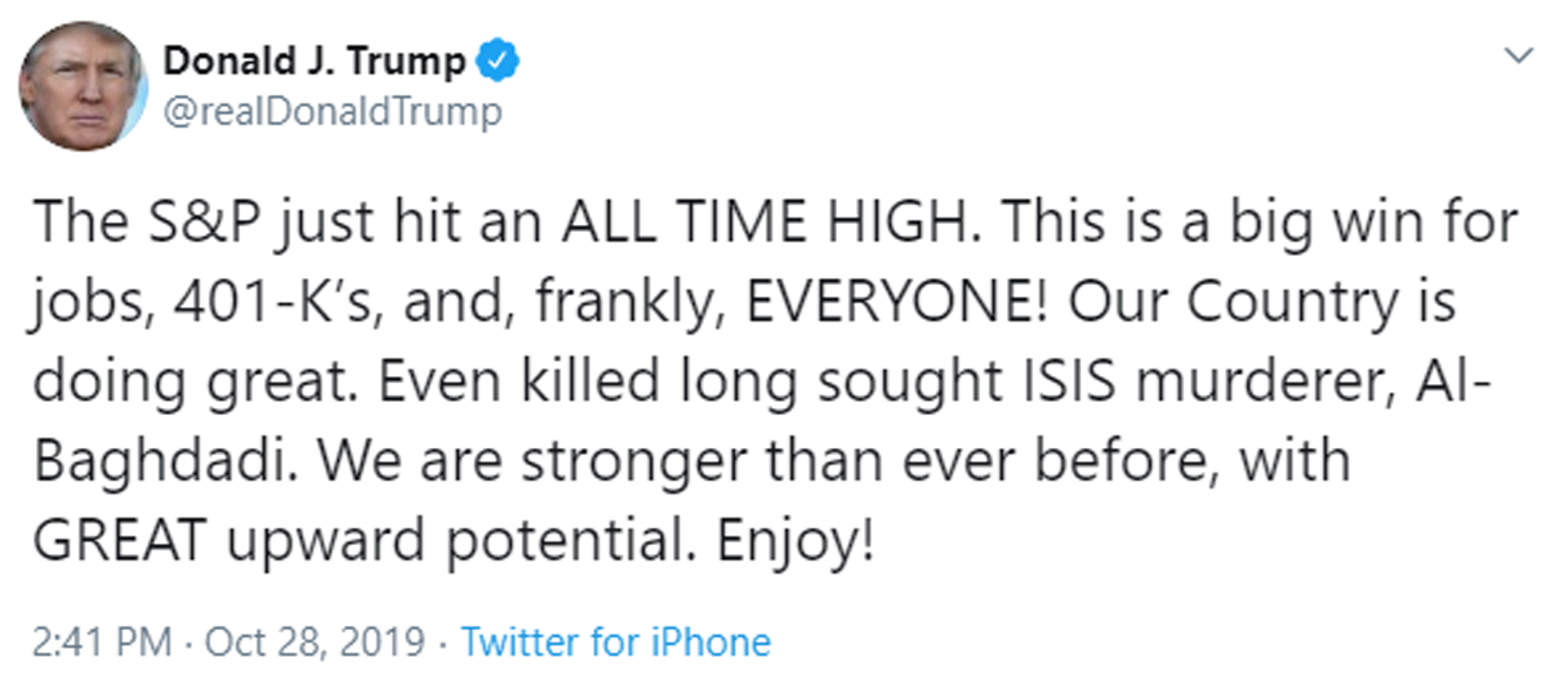

“On average, we’ve seen new all-time highs some 18 to 20 times a year. ”

Consider an ordinary savings account. If you're lucky enough to get some interest, your bank account will reach a new high every single day. (It's just too bad the increments are so minuscule.)

On average, we've seen new all-time highs some 18 to 20 times a year. After the dot-com bubble burst, however, the S&P 500 took more than seven years to surpass its previous high. In Norway, more than six years passed before the Norwegian benchmark index climbed above its pre-crisis peak.

In a sense, then, the real danger is having to wait excessively long for the next all-time high.

Rest assured, however, that there is an infinite supply of new all-time highs. After all, stocks don't generate returns because of business cycles, interest rates or the absence of silly politics. You make money on stocks because the companies you own make money on the products and services they sell. If they keep making money – the S&P 500 has an unbroken record of almost 150 years of positive earnings – the market will keep rising, albeit in leaps and bounds.

This much is certain: You'll never see the market hitting a new all-time low.

Historical returns are no guarantee for future returns. Future returns will depend, inter alia, on, market developments, the portfolio manager’s skill, the fund’s risk profile, as well as fees for subscription, management and redemption. Returns may become negative as a result of negative price developments. This is marketing communication.