We continue to invest according to our value oriented investment philosophy and are confident that we will be rewarded by being patient and focusing on the companies’ valuations and cash generation. In recent days, all investment team members of Pareto Global have increased their private holdings in the fund.

The type of investment strategy that performs the best in the market changes. In recent years, so-called growth stocks have beat value-oriented stocks, however. Over time a value stocks have given the best returns.

- Sectors and companies with good momentum in revenue growth (e.g. technology and medical equipment), which are generally quite resistant to a potential recessions, have outperformed significantly

- Valuation has been of less importance when these factors have been in place

Value oriented investment strategy

Pareto Global has a value-oriented investment philosophy. Our investment strategy is to buy well-run companies at an attractive price. Sometimes such solid companies face temporary challenges, which offers opportunities for a solid upside to a long-term investor.

- We have invested in equities at attractive levels, which more than reflect the challenges the companies face

- The majority of new investments we have made over the last few years have been entered into after the share prices have dropped significantly. For some, the prices have continued to come down and momentum has remained weak

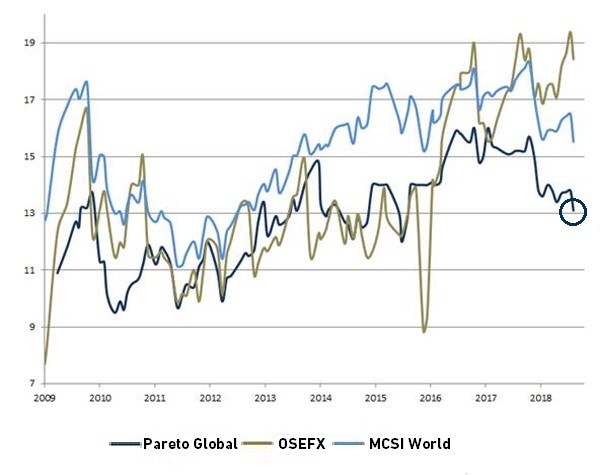

2009–2018 PE

Pareto Global PE (2019) = 13.0

- Given the current dynamics in the markets, we have put too much weight into long term valuation, and not enough in momentum driven stocks and companies which are unaffected by economic cycles

Our portfolio consists of very solid companies with leading market positions and strong balances, high profitability and an average of seven per cent return on free cash flow - against the market of 5.5 percent, as well as revenue growth of around 14 per cent this year and 10 per cent next year.

“If a business does well, the stock eventually follows.”

Abbott Laboratories

The share price of Abbott Laboratories rose sharply in

September after the company presented very good results

from an eight-year study.

The study included treatment of heart failure and severe diseases due to leakage of the heart valve, and showed that Abbott's Mitra-Clip provides significantly better results than what is considered as standard treatment today. The Mitra-Clip system has been used for over ten years for the mildest disease cases and gives Abbott approximately USD 500 million in annual revenues as a leading player in this growing market.

A potential extension of the areas of use can double or triple the addressable market. Abbott has a very strong position in medical equipment for treating cardiovascular disease following the acquisition of St Jude Medical in 2017.

Summary

We invest according to our value-oriented investment philosophy and are confident that we will be rewarded by being patient and focusing on the companies' valuations and cash generation. Over time a value stocks have given the best returns.

The portfolio is now priced at attractive 12.8 times expected earnings in 2019:

- Is priced at attractive levels both in absolute and relative terms, to historic valuation of the fund and the MSCI World

- The reason for the fund's underperformance is primarily due to negative share price movements rather than that a lack of earnings growth

Portfolio management team

Pareto Global A had a return of 207.8% accumulated, and 12.2% annualized, in the period 1 January 2009–31 September 2018. Historical returns are no guarantee for future returns. Future returns will depend, inter alia, on, market developments, the portfolio manager's skill, the fund's risk profile, as well as fees for subscription, management and redemption. Returns may become negative as a result of negative price developments. Fund prospectus, KIID, annual and semiannual reports are available at www.paretoam.com/en/fund-related-documents. Pareto Asset Management seeks to the best of its ability to ensure that all information given in this document is correct, however, makes reservations regarding possible errors and omissions. Statements in this document may reflect the portfolio managers' viewpoint at a given time, and this viewpoint may be changed without notice. This document should not be perceived as an offer or recommendation to buy or sell financial instruments. Pareto Asset Management does not assume responsibility for direct or indirect loss or expenses incurred through use or understanding of the document. The source is Pareto Asset Management unless otherwise is stated.