Never mind their lack of precision:

Some talk about an earnings recession; some talk about the manufacturing sector; some seem to mean Europe, the US or both – most, however, don't actually define what they mean.

According to the IMF, there have been only four global recessions since World War II, the last one an upshot of the global financial crisis, breaking out in 2009 – the only year with a drop in global GDP in the World Bank database (starting in 1960). They do look at a wider set of measures, but their definition certainly includes a decline in real GDP.

In other words, a truly global recession would be a dramatic turn of events, especially considering last year's 3.8 per cent GDP growth rate and a recent IMF estimate of 3.5 per cent global growth in 2020. Still, that's exactly what some seem to be predicting (unless, of course, they're a bit sloppy with words).

So ... are we in for a nasty surprise?

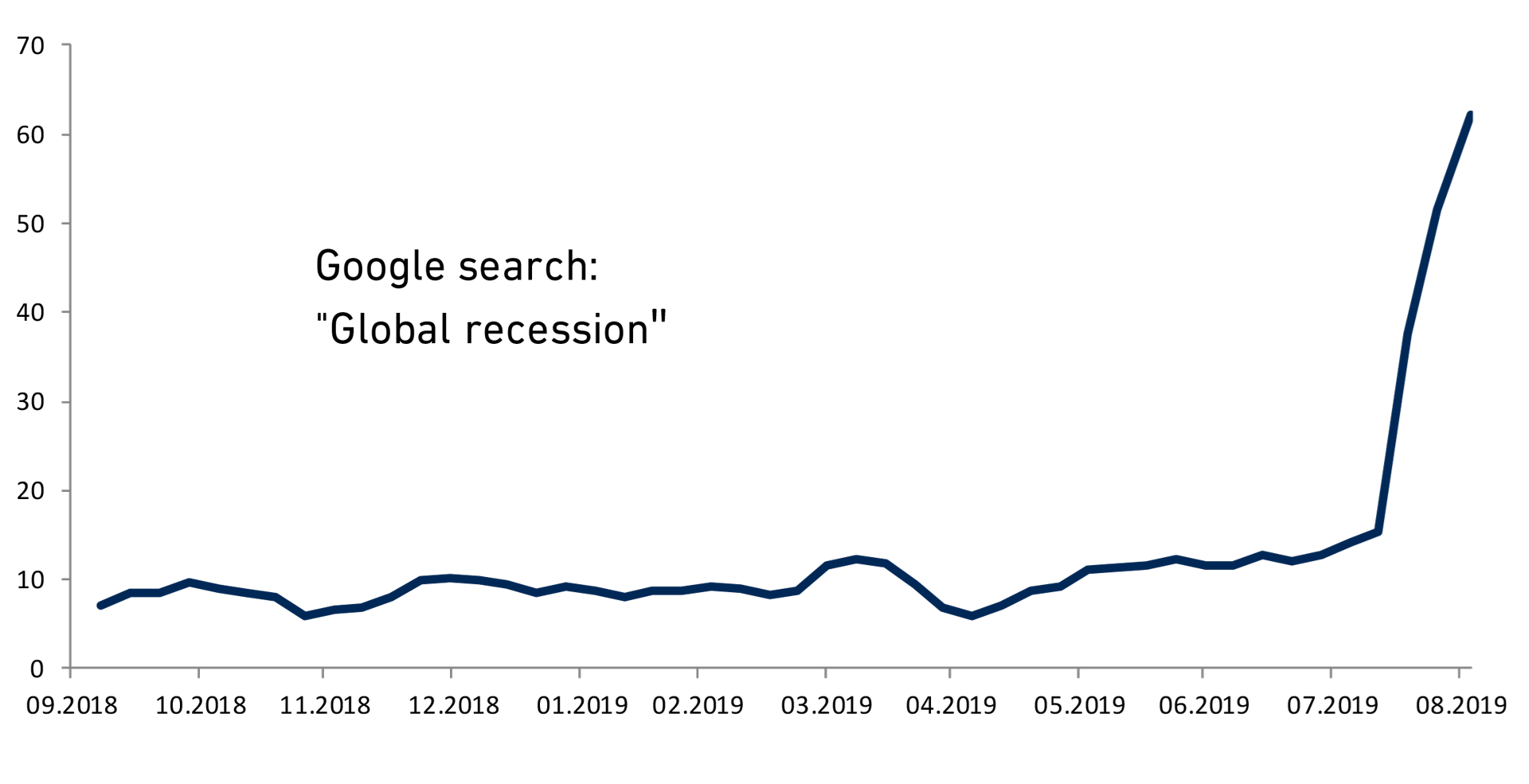

There is an answer to this question and it is very short: no. Surprises are rarely preceded by massive warnings.

Is there anybody out there still oblivious of these warnings? I doubt it. This information, or perhaps this barrage of opinions, is received, understood and digested by scores of investors, meaning that it should be incorporated into today's stock prices. In market lingo, it should be fully discounted.

Let's recall some conclusions from professors Elroy Dimson, Paul Marsh and Mike Staunton, summing up their work on the relation between economic growth and stock market returns:

"We find no evidence of economic growth being a predictor of stock market performance."

"We find that there is no relationship between annual GDP growth rates and contemporaneous stock market returns."

"In other words, if the market is effective, we should also find that stock prices are a predictor of future economic growth. That, too, is what we find."

See? If markets have been a bit jittery of late, it is precisely because this information is being digested. Admittedly, there's always a fat chance that the average investor is way too optimistic.

But totally ignorant?

Scary month?

Historical returns are no guarantee for future returns. Future returns will depend, inter alia, on, market developments, the portfolio manager’s skill, the fund’s risk profile, as well as fees for subscription, management and redemption. Returns may become negative as a result of negative price developments. This is marketing communication.